Federal Budget 2021/22 – For Individuals

1. Personal Income Tax Changes

1.1 Retaining the Low and Middle Income Tax Offset (‘LMITO’) For The 2022 Income Year

1.1 Retaining the Low and Middle Income Tax Offset (‘LMITO’) For The 2022 Income Year

The Government has announced that it will retain the LMITO for one more income year, so that it will still be available for the 2022 income year. Under current legislation, the LMITO was due to be removed from 1 July 2021.

The LMITO is a non-refundable tax offset that provides tax relief for low and middle income taxpayers and is available in addition to the Low Income Tax Offset (‘LITO’).

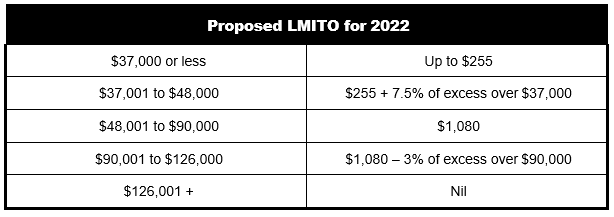

The LMITO is proposed to apply as follows for the 2022 income year.

Consistent with current arrangements, the LMITO will be applied to reduce the tax payable by individuals when they lodge their tax returns for the 2022 income year.

1.2 Increasing the Medicare Levy Low-income Thresholds

The Government will increase the Medicare levy low-income thresholds for singles, families and seniors and pensioners for the 2021 income year, as follows:

• The threshold for singles will be increased from $22,801 to $23,226.

• The family threshold will be increased from $38,474 to $39,167.

• The threshold for single seniors and pensioners will be increased from $36,056 to $36,705.

• The family threshold for seniors and pensioners will be increased from $50,191 to $51,094.

For each dependent child or student, the family income thresholds increase by a further $3,597, up from the previous amount of $3,533.

1.3 Modernising the individual tax residency rules

The Government has announced that it will replace the individual tax residency rules with a new, modernised framework.

The primary test will be a simple ‘bright line’ test – a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident.

Individuals who do not meet the primary test will be subject to secondary tests that depend on a combination of physical presence and measurable, objective criteria.

Australia’s current tax residency rules are difficult to apply in practice, creating uncertainty and resulting in high compliance costs for individuals and their employers.

The new framework is based on recommendations made by the Board of Taxation in its 2019 report to Government, ‘Reforming individual tax residency rules – a model for modernisation’. According to the Government, this new framework will be easier to understand and apply in practice, deliver greater certainty, and lower compliance costs for globally mobile individuals and their employers.

This measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

1.4 Reducing Compliance Costs For Individuals Claiming Self-education Expense Deductions

The Government will remove the exclusion of the first $250 of deductions for prescribed courses of education.

Currently, the first $250 of a prescribed course of education expense is not tax deductible. Removing this $250 exclusion is expected to reduce compliance costs for individuals claiming self- education expense deductions.

This measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

1.5 Employee Share Schemes – Removing ‘Cessation of Employment’ As A Taxing Point and Reducing Red Tape

The Government will remove the ‘cessation of employment’ taxing point for tax-deferred Employee Share Schemes (‘ESS’) that are available for all companies.

This change will apply to ESS interests issued from the first income year after the date of Royal Assent of the enabling legislation.

Currently, under a tax-deferred ESS, where certain criteria are met, employees may defer tax until a later tax year (‘the deferred taxing point’). The deferred taxing point is the earliest of:

(a) cessation of employment;

(b) in the case of shares, when there is no risk of forfeiture and no restrictions on disposal;

(c) in the case of options, when the employee exercises the option and there is no risk of forfeiting the resulting share and no restriction on disposal; and

(d) the maximum period of deferral of 15 years.

This change will remove the ‘cessation of employment’ taxing point (i.e., point (a) above) and result in tax being deferred until the earliest of the remaining taxing points (i.e., points (b) to (d) above).

In addition to this change, the Government will also reduce red tape for ESS:

• where employers do not charge or lend to the employees to whom they offer ESS – by removing regulatory requirements for ESS; and

• where employers do charge or lend – by streamlining requirements for unlisted companies making ESS offers that are valued at up to $30,000 per employee per year.

This measure aims to help Australian companies to engage and retain the talent they need to compete on a global stage, consistent with recommendations from the Global Business and Talent Attraction.

1.6 Exemption For Pay and Allowances For Operation Paladin

The Government will provide a full income tax exemption for the pay and allowances of Australian Defence Force (‘ADF’) personnel deployed to Operation Paladin.

Operation Paladin is Australia’s contribution to the United Nations Truce Supervision Organisation, with ADF personnel deployed in Israel, Jordan, Syria, Lebanon and Egypt.

This measure ensures that personnel are subject to consistent tax treatment regardless of the operational area of Operation Paladin to which they are deployed.

The exemption will apply from 1 July 2020 (i.e., from the 2021 income year).